Why Gold as a basis of currency is a bad idea

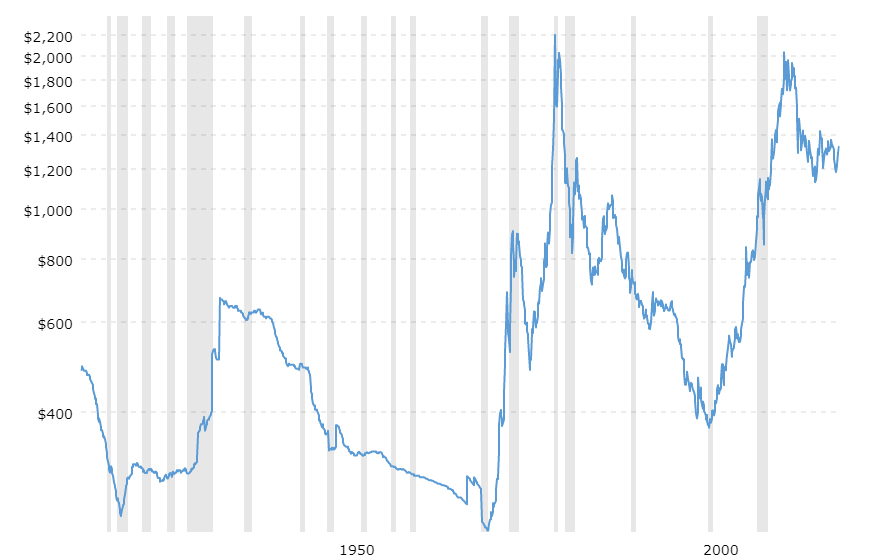

Advocates for a return to the silver and gold standard claim that it is the only commodity that has maintained its value over the years. But the truth is that we have seen massive fluctuations in gold values through the years – it is by no means stable. In times of economic uncertainty many do convert their money or stocks in corporations to gold, driving the price of gold up significantly. When the stock market prospers people divest of gold driving its value down again. So the theory that gold has always maintained its value is not true, because it can be traded as a commodity and thus subject to market demand. When interest rates jumped up to over 18% back in 1980, the gold value went through the roof in growth and many people sought it driving the price up to very unrealistic values at the time. When interest rates dropped so did gold. This was all controlled deliberately by the banking establishment who increased the interest rates on purpose, made a fortune on gold, then sold it off at exorbitant prices to the common people before dropping interest rates again and driving gold prices back down. This corruption and manipulation has been going on for years by the central and commercial banks. The chart below shows how much the value of gold has fluctuated over the last 100 years.

But perhaps the biggest problem with returning to a gold standard as a means of currency value is the fact that the majority of gold is in the possession of only a handful of wealthy people, banks, governments and corporations. If gold becomes the standard these people will have absolute control of currency.

How will the poor ever get their hands on it? Because there is limited supply, demand will significantly drive up the value making the rich richer and the poor poorer. So in the end we are back to the same problem we have now under the fiat system. Both systems favour the rich who can convert their stocks and currency to gold.

One must also remember that when money was backed by gold it was devalued due to the fractal banking system – i.e. Banks could loan out 10 times more than the gold they had on deposit. Furthermore, interest rates charged by the central banks and other banks was the primary driving force behind individual behaviour. For example we saw gold soar in price when interest rates went above 18% yet suddenly declined when interest rates dropped. Gold is not at all the holy grail as many purport. Our financial problems did not occur when President Nixon took the US dollar off the gold standard. It started long before that so a return to the old system will not fix the problem. The stock market crash of 1929 happened when gold and silver backed the US dollar so the problems we faced then and now have less to do with what is backing our money than fiscal policy and the corrupt banking system that now controls the world.

The principle that the elite bankers operate on is , “The borrower is a slave to the lender”. The enslavement of governments and ordinary people is the result of debt. Without debt in the current system, there would be no money or it would at least be severely contracted resulting in economic disaster. The debt system is the real culprit and the banking system are the “lords” who bring us all under enslavement. The only way out of this mess is to replace the current system with one that is fair and not controlled by the rich.

The other glaring problem is the issue of population growth. When population growth exceeds new gold being mined we land up with a deficit in available money per person. This is severely problematic resulting even more in a polarization of the rich and the poor. Money must be expansive though not inflationary. In other words if you could expand the money supply to ensure every human being has sufficient amounts of it to live without indebtedness (which is the current way money is created), then you would have a responsible system on money supply.

The world is rapidly changing to electronic digital power, driving communications ( i.e. Social media), information (via internet search engines) and money is already mostly digital. The future of money will most certainly be digital but the basis of its creation needs to be radically changed from the current debt based economy. Silver and Gold as a basis of currency value is fraught with too many problems and hence not the solution nor the future of money.